San Francisco Real Estate

April 2024 Report

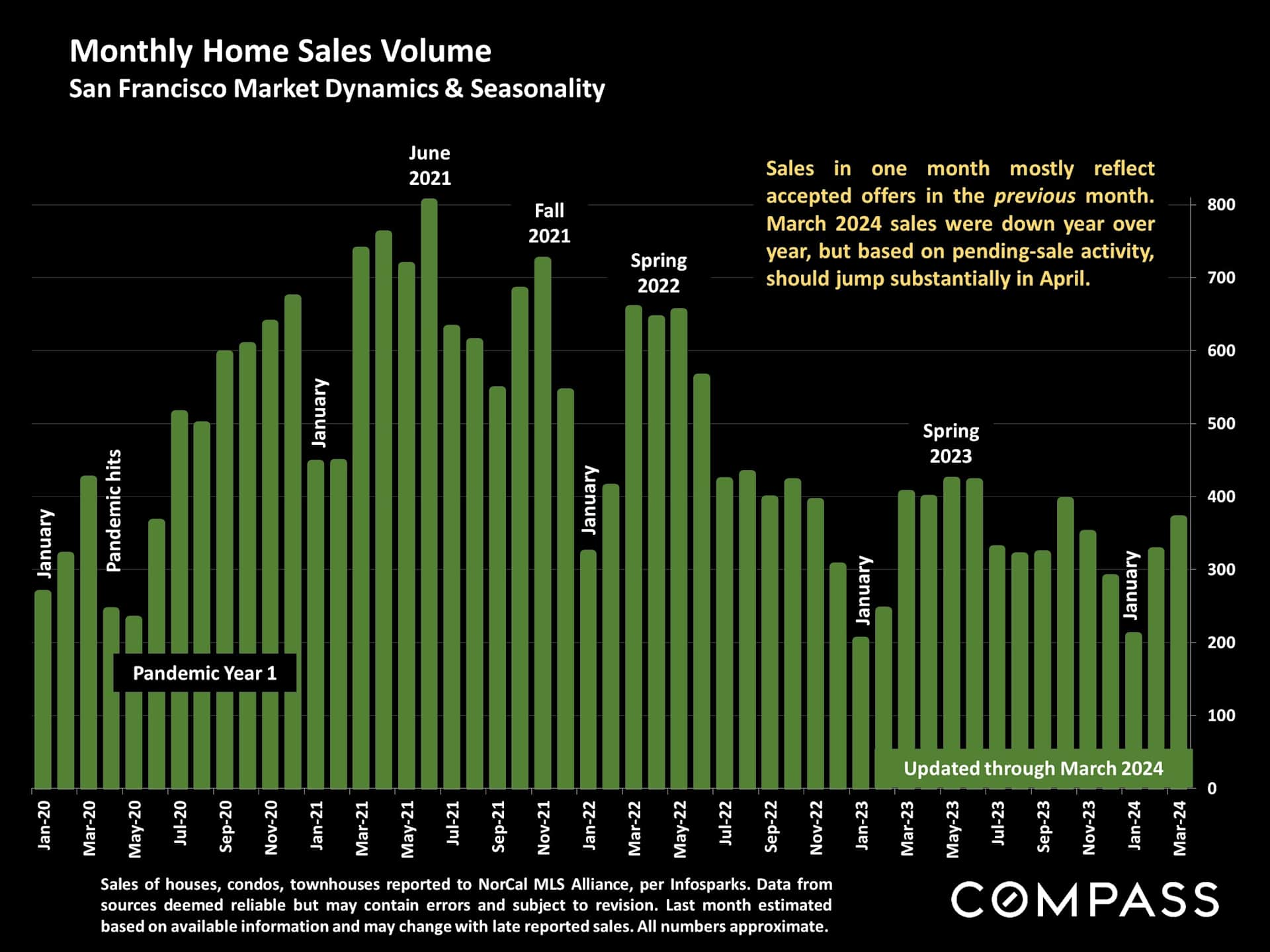

Q2 May See the Hottest Market

Since the Peak of the Pandemic Boom

Ever since the beginning of the year, and now moving into the spring selling season, striking

shifts in supply and demand have occurred and continued to accelerate, resulting in a

dramatic leap in the heat and competitiveness of market conditions. Based on current

indicators, and what is being experienced on the ground as new listings arrive on the

market, deals are negotiated, and homes go into contract, it appears almost certain that

significant home price increases will continue in Q2 2024.

Macroeconomic Conditions

In the 8 weeks through early April, the weekly average, 30-year conforming-loan interest

rate has oscillated between 6.74% and 6.94%: Up from January, but still well down from last

fall. In the last month, the S&P 500 & Nasdaq stock market indices continued to hit new all-

time highs, with substantial effects on household wealth. After the big jump in December-

January, consumer confidence is at its highest point in almost 3 years. Monthly inflation

rates have remained stable since October, ranging from 3.1% to 3.3%: Higher than the Fed’s

2% goal, but reductions in its benchmark rate later this year are still commonly expected.

Both the latest national and San Francisco unemployment readings, at 3.8%, remain close to

historic lows.